Featured

Table of Contents

- – What should I look for in a Income Protection ...

- – What does Whole Life Insurance cover?

- – Who provides the best Policyholders?

- – What is the best Long Term Care option?

- – Is there a budget-friendly Death Benefits op...

- – Who has the best customer service for Univer...

- – What is included in Mortgage Protection cove...

- – What should I look for in a Long Term Care p...

- – Is Wealth Transfer Plans worth it?

Juvenile insurance policy might be sold with a payor benefit biker, which provides for forgoing future premiums on the youngster's policy in the event of the fatality of the person that pays the costs. Elderly life insurance policy, often referred to as rated death advantage strategies, provides eligible older applicants with marginal whole life protection without a medical checkup.

These policies are usually much more pricey than a completely underwritten policy if the person qualifies as a typical risk. This type of coverage is for a tiny face quantity, normally purchased to pay the burial costs of the guaranteed.

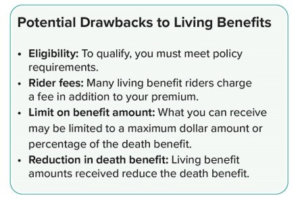

These plans can be a monetary source you can use if you're identified with a covered illness that's thought about persistent, vital, or terminal. Life insurance coverage plans drop right into 2 categories: term and permanent.

The 3 most usual sorts of are entire, global, and variable. Unlike term life, entire life insurance policy does not have an expiry day. Furthermore, a part of the premiums you pay into your whole life plan builds cash worth in time. Some insurance provider use little whole life plans, often described as.

What should I look for in a Income Protection plan?

Today, the cost of an ordinary term life insurance policy for a healthy and balanced 30-year-old is approximated to be about $160 each year simply $13 a month. 1While there are a great deal of variables when it comes to how much you'll spend for life insurance coverage (plan kind, advantage quantity, your profession, and so on), a policy is likely to be a whole lot much less costly the more youthful and healthier you go to the moment you acquire it.

Beneficiaries can generally receive their cash by check or electronic transfer. Furthermore, they can additionally choose exactly how much money to get. They can get all the cash as a lump amount, by means of an installment or annuity strategy, or a kept possession account (where the insurance company acts as the bank and permits a recipient to write checks against the balance).3 At Freedom Mutual, we recognize that the choice to get life insurance is a vital one.

What does Whole Life Insurance cover?

Every initiative has been made to guarantee this information is existing and proper. Details on this web page does not ensure registration, benefits and/or the ability to make changes to your advantages.

Age decrease will apply during the pay period containing the covered person's appropriate birthday celebration. VGTLI Age Decrease Age of Staff Member Amount of Insurance 65 65% 70 40% 75 28% 80 20% Recipients are the individual(s) marked to be paid life insurance policy advantages upon your fatality. Recipients for VGTLI coincide when it comes to GTLI.

Who provides the best Policyholders?

This benefit may be proceeded until age 70. Qualified retirees will get a Workday alert to choose Senior citizen GTLI (RGTLI) protection. You have thirty day from your retirement date to choose this protection using one of the 2 choices below. You are urged to assign recipients as part of making this political election.

Succeeding quarterly premiums in the amount of $69 are due on the very first day of the following months: January, April, July and October. A premium due notice will certainly be sent to you roughly 30 days before the following due date.

You have the alternative to pay online utilizing an eCheck or credit/debit card. Please note that service fee might apply. You likewise have the option to send by mail a check or cash order to the listed below address: The Ohio State UniversityAccounts ReceivablePO Box 182905Columbus, OH 43218-2905 Costs rates for this program go through transform.

Premium amounts are established by and paid to the life insurance coverage supplier.

What is the best Long Term Care option?

If you retire after age 70, you might convert your GTLI insurance coverage to an individual life insurance policy (up to $200,000 maximum). Premium quantities are established by and paid to the life insurance supplier.

The advantage quantity is based on your years of work in a qualified appointment at the time of retirement and is payable to your beneficiary(-ies) as adheres to: $2,000 $3,000 $4,000 $5,000 This is meant to be a summary. Describe the Strategy Document for complete info. In the occasion the details on these pages differs from the Strategy Document, the Plan Record will govern.

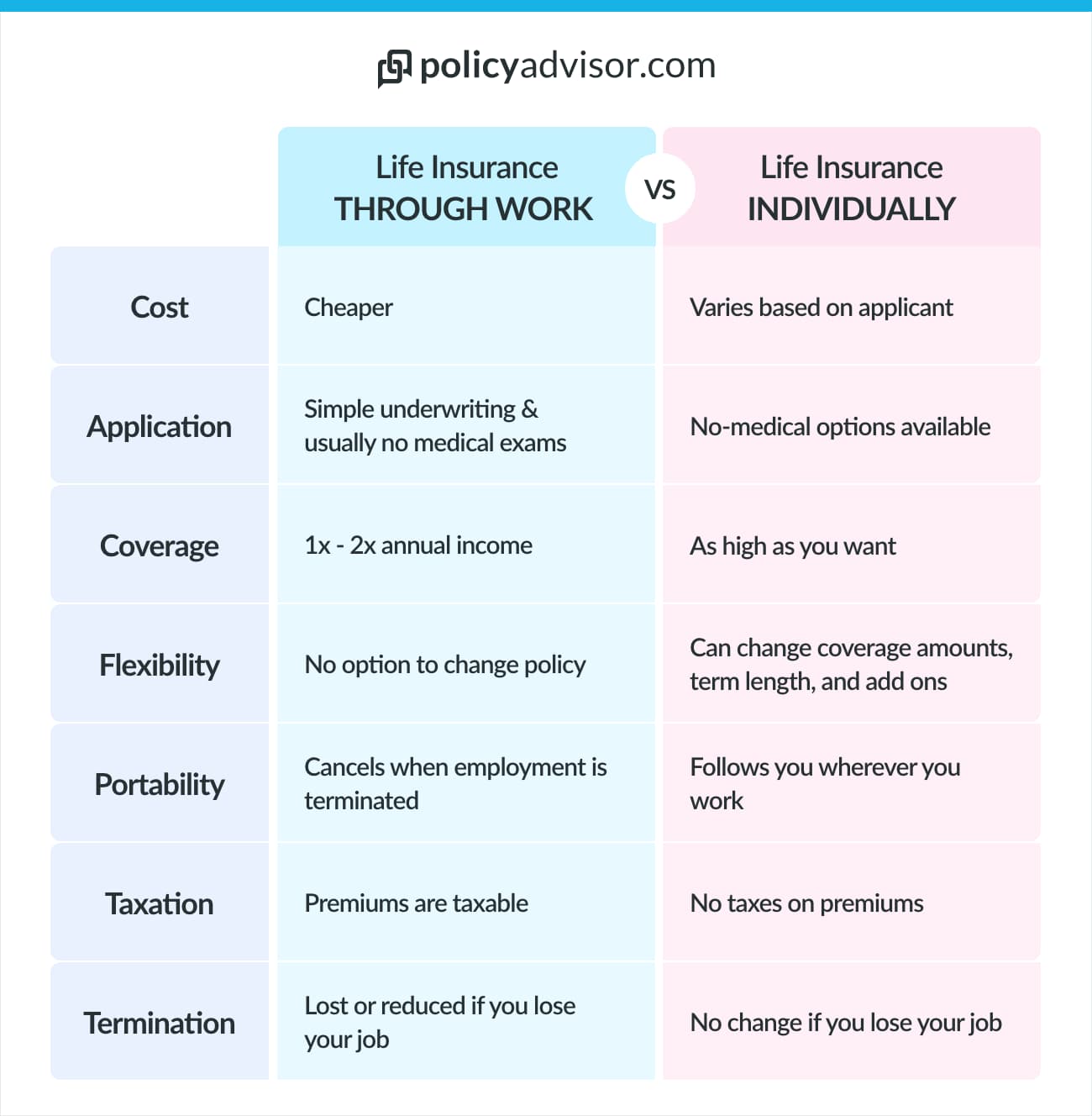

Term life insurance coverage policies run out after a particular number of years. Permanent life insurance plans remain active up until the insured person passes away, stops paying costs, or surrenders the plan. A life insurance plan is only as great as the monetary toughness of the life insurance coverage business that issues it.

Complete what these expenses would be over the following 16 approximately years, include a bit much more for rising cost of living, and that's the survivor benefit you could intend to buyif you can afford it. Burial or last expense insurance is a sort of permanent life insurance policy that has a small survivor benefit.

Is there a budget-friendly Death Benefits option?

Lots of variables can impact the expense of life insurance policy premiums. Certain things may be past your control, but various other standards can be managed to potentially reduce the cost prior to (and even after) using. Your wellness and age are the most vital elements that figure out price, so buying life insurance as quickly as you need it is commonly the very best strategy.

If you're found to be in far better health, then your premiums might lower. Investopedia/ Lara Antal Think about what costs would require to be covered in the event of your fatality.

There are handy devices online to compute the swelling amount that can satisfy any kind of prospective expenses that would certainly require to be covered. Life insurance applications normally call for individual and family members medical background and recipient details. You might require to take a clinical exam and will certainly need to divulge any preexisting medical problems, background of moving offenses, Drunk drivings, and any type of unsafe hobbies (such as automobile racing or sky diving).

Because females statistically live much longer, they typically pay reduced rates than men of the same age. A person that smokes is at danger for numerous health and wellness concerns that might shorten life and boost risk-based premiums. Medical examinations for many policies consist of screening for health and wellness conditions such as cardiovascular disease, diabetes mellitus, and cancer, plus related medical metrics that can suggest wellness risks.: Hazardous line of work and pastimes can make premiums far more pricey.

Who has the best customer service for Universal Life Insurance?

A history of relocating infractions or driving while intoxicated can drastically boost the price of life insurance policy costs. Basic types of identification will additionally be required before a policy can be created, such as your Social Protection card, driver's certificate, or U.S. passport. When you've put together every one of your needed information, you can gather several life insurance policy prices estimate from various carriers based upon your research study.

Due to the fact that life insurance policy costs are something you will likely pay month-to-month for years, finding the policy that finest fits your requirements can conserve you a massive quantity of money. Our lineup of the ideal life insurance business can provide you a jump begin on your research. It details the companies we have actually located to be the ideal for various kinds of demands, based upon our research study of nearly 100 carriers.

Below are some of the most crucial attributes and securities offered by life insurance policy policies. A lot of people use life insurance policy to provide cash to beneficiaries who would certainly endure economic hardship upon the insured's fatality. However, for well-off people, the tax benefits of life insurance policy, consisting of the tax-deferred development of cash worth, tax-free returns, and tax-free survivor benefit, can give added tactical chances.

, but that's why wealthy individuals occasionally buy irreversible life insurance coverage within a trust fund., which is unlawful.

What is included in Mortgage Protection coverage?

Wedded or not, if the death of one adult might suggest that the various other can no longer afford finance repayments, maintenance, and tax obligations on the home, life insurance policy might be a great idea. One instance would certainly be an involved pair who secure a joint mortgage to purchase their initial house.

This assistance may additionally include direct financial backing. Life insurance can aid repay the grown-up child's expenses when the parent passes away - Whole life insurance. Young person without dependents rarely require life insurance policy, however if a parent will get on the hook for a youngster's debt after their fatality, the child may want to carry adequate life insurance policy to settle that debt

A 20-something adult may purchase a policy even without having dependents if they anticipate to have them in the future. Stay-at-home spouses ought to have life insurance as they add substantial economic worth based on the job they do in the home. A small life insurance plan can supply funds to honor an enjoyed one's death.

What should I look for in a Long Term Care plan?

This method is called pension maximization. such as cancer, diabetic issues, or smoking. Note, nonetheless, that some insurance providers might deny protection for such people or charge very high rates. Each policy is one-of-a-kind to the insured and insurance firm. It is very important to assess your plan document to comprehend what risks your policy covers, just how much it will pay your beneficiaries, and under what situations.

That security issues, given that your heirs might not obtain the fatality advantage till several decades right into the future. Investopedia has actually assessed scores of business that offer all various kinds of insurance and rated the finest in countless classifications. Life insurance policy can be a prudent financial device to hedge your wagers and supply security for your loved ones in case you die while the plan is in force.

What expenses couldn't be met if you died? It is still important to take into consideration the impact of your possible death on a partner and consider how much economic assistance they would require to regret without fretting about returning to function prior to they're ready.

If you're getting a plan on one more member of the family's life, it's essential to ask: what are you trying to insure? Youngsters and seniors really don't have any kind of purposeful earnings to change, yet interment expenses may require to be covered in case of their death. On top of that, a parent may intend to shield their kid's future insurability by purchasing a moderate-sized plan while they are young.

Is Wealth Transfer Plans worth it?

Term life insurance policy has both parts, while long-term and entire life insurance policy policies additionally have a money value part. The death benefit or stated value is the quantity of cash the insurer assures to the beneficiaries determined in the policy when the insured dies. The insured could be a parent and the recipients may be their youngsters, for instance.

Costs are the cash the insurance policy holder pays for insurance coverage.

Table of Contents

- – What should I look for in a Income Protection ...

- – What does Whole Life Insurance cover?

- – Who provides the best Policyholders?

- – What is the best Long Term Care option?

- – Is there a budget-friendly Death Benefits op...

- – Who has the best customer service for Univer...

- – What is included in Mortgage Protection cove...

- – What should I look for in a Long Term Care p...

- – Is Wealth Transfer Plans worth it?

Latest Posts

Securus Final Expense

Senior Final Expense Life Insurance Program

Senior Solutions Final Expense

More

Latest Posts

Securus Final Expense

Senior Final Expense Life Insurance Program

Senior Solutions Final Expense