Featured

Table of Contents

Term Life Insurance Policy is a sort of life insurance policy policy that covers the insurance holder for a details quantity of time, which is referred to as the term. The term sizes vary according to what the private selects. Terms normally vary from 10 to three decades and increase in 5-year increments, giving degree term insurance coverage.

They generally provide a quantity of coverage for a lot less than long-term sorts of life insurance. Like any plan, term life insurance policy has advantages and disadvantages depending on what will certainly function best for you. The benefits of term life consist of price and the ability to customize your term size and coverage amount based upon your needs.

Depending on the type of policy, term life can supply dealt with costs for the entire term or life insurance on degree terms. The fatality advantages can be fixed.

*** Rates show policies in the Preferred Plus Rate Class concerns by American General 5 Stars My agent was extremely knowledgeable and valuable in the procedure. July 13, 2023 5 Stars I was satisfied that all my needs were fulfilled quickly and properly by all the reps I talked to.

What Is Term Life Insurance Level Term? A Complete Guide

All documentation was digitally finished with access to downloading and install for individual documents maintenance. June 19, 2023 The endorsements/testimonials offered need to not be construed as a suggestion to purchase, or an indication of the value of any kind of service or product. The reviews are actual Corebridge Direct clients who are not connected with Corebridge Direct and were not supplied payment.

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

There are numerous sorts of term life insurance policy plans. As opposed to covering you for your whole life expectancy like entire life or universal life plans, term life insurance policy only covers you for a marked duration of time. Policy terms typically range from 10 to thirty years, although much shorter and longer terms might be available.

If you want to preserve coverage, a life insurance provider may provide you the alternative to restore the policy for another term. If you added a return of premium biker to your plan, you would obtain some or all of the cash you paid in premiums if you have actually outlasted your term.

Degree term life insurance may be the finest alternative for those that want insurance coverage for a set duration of time and want their costs to continue to be stable over the term. This may put on buyers worried about the price of life insurance and those who do not want to alter their survivor benefit.

That is due to the fact that term plans are not guaranteed to pay out, while permanent plans are, offered all costs are paid. Level term life insurance coverage is commonly extra pricey than decreasing term life insurance policy, where the survivor benefit reduces in time. Aside from the kind of plan you have, there are several other variables that assist establish the price of life insurance policy: Older applicants typically have a higher death danger, so they are generally a lot more expensive to insure.

On the other hand, you may be able to safeguard a cheaper life insurance coverage rate if you open up the policy when you're more youthful. Comparable to advanced age, inadequate wellness can additionally make you a riskier (and extra pricey) candidate permanently insurance policy. Nonetheless, if the problem is well-managed, you may still have the ability to find budget friendly coverage.

What Is Increasing Term Life Insurance Coverage and How Does It Work?

However, wellness and age are commonly far more impactful premium factors than gender. Risky hobbies, like scuba diving and sky diving, may lead you to pay even more permanently insurance. Likewise, high-risk tasks, like window cleaning or tree trimming, may additionally increase your cost of life insurance policy. The finest life insurance policy company and plan will depend upon the individual looking, their individual ranking variables and what they need from their policy.

The initial action is to identify what you need the policy for and what your budget plan is. Some business offer on-line pricing quote for life insurance, but many need you to speak to an agent over the phone or in individual.

1Term life insurance policy provides short-lived security for an important period of time and is generally much less costly than irreversible life insurance policy. 2Term conversion standards and constraints, such as timing, might use; for example, there may be a ten-year conversion advantage for some products and a five-year conversion advantage for others.

3Rider Insured's Paid-Up Insurance policy Purchase Option in New York. There is a price to exercise this rider. Not all participating plan proprietors are qualified for rewards.

Our term life alternatives consist of 10, 15, 20, 25, 30, 35, and 40-year policies. One of the most preferred type is level term, suggesting your payment (premium) and payout (death benefit) stays level, or the same, up until the end of the term duration. Short Term Life Insurance. This is one of the most straightforward of life insurance policy alternatives and calls for very little maintenance for plan proprietors

As an example, you might provide 50% to your partner and split the remainder among your adult youngsters, a parent, a close friend, and even a charity. * In some circumstances the survivor benefit may not be tax-free, find out when life insurance policy is taxable.

How Does Level Benefit Term Life Insurance Protect You?

There is no payment if the policy ends prior to your death or you live past the policy term. You may have the ability to restore a term plan at expiration, but the costs will be recalculated based on your age at the time of renewal. Term life insurance policy is usually the least pricey life insurance readily available due to the fact that it offers a fatality advantage for a restricted time and does not have a cash money value part like permanent insurance policy - Term life insurance with level premiums.

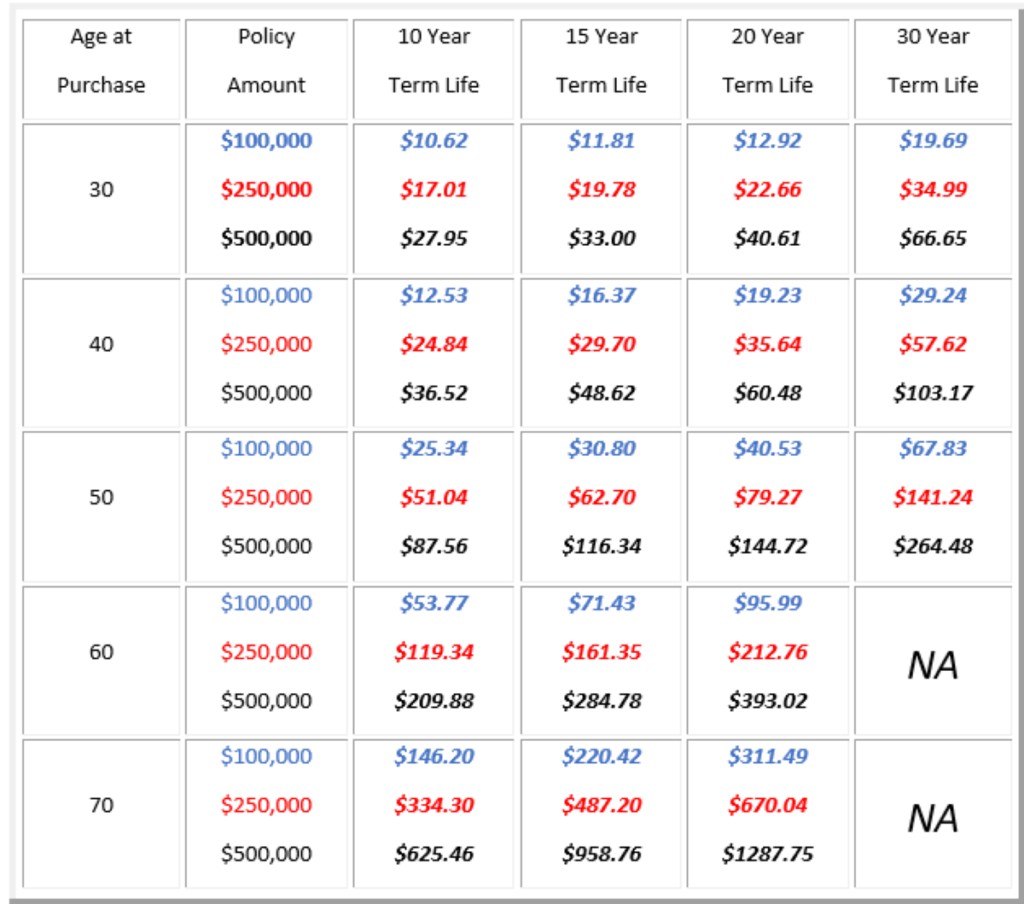

At age 50, the premium would certainly climb to $67 a month. Term Life Insurance policy Fees 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life plan, for men and females in superb health and wellness.

The decreased threat is one aspect that enables insurance firms to charge reduced costs. Rates of interest, the financials of the insurance policy business, and state laws can additionally impact premiums. In general, companies typically offer far better rates at the "breakpoint" coverage degrees of $100,000, $250,000, $500,000, and $1,000,000. When you think about the quantity of insurance coverage you can get for your premium bucks, term life insurance policy often tends to be the least pricey life insurance coverage.

Latest Posts

Securus Final Expense

Senior Final Expense Life Insurance Program

Senior Solutions Final Expense