Featured

Table of Contents

Term life insurance policy is a type of plan that lasts a certain size of time, called the term. You select the length of the plan term when you initially take out your life insurance coverage.

Choose your term and your amount of cover. You may have to respond to some concerns concerning your medical background. Select the plan that's right for you. Currently, all you need to do is pay your costs. As it's level term, you understand your premiums will certainly remain the very same throughout the regard to the plan.

What does Level Term Life Insurance Coverage cover?

Life insurance covers most scenarios of death, however there will certainly be some exclusions in the terms of the policy - Guaranteed level term life insurance.

After this, the policy ends and the making it through companion is no longer covered. Joint policies are generally a lot more cost effective than single life insurance policies.

This safeguards the getting power of your cover amount against inflationLife cover is a terrific point to have since it supplies financial defense for your dependents if the worst happens and you die. Your liked ones can likewise use your life insurance policy payout to spend for your funeral service. Whatever they select to do, it's terrific peace of mind for you.

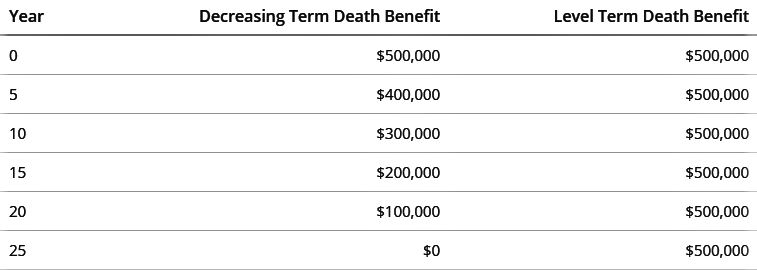

Nonetheless, degree term cover is terrific for fulfilling day-to-day living costs such as house costs. You can likewise use your life insurance policy advantage to cover your interest-only home mortgage, payment mortgage, college charges or any kind of various other debts or recurring payments. On the other hand, there are some disadvantages to degree cover, compared to various other kinds of life plan.

Level Term Life Insurance Protection

Words "level" in the phrase "level term insurance coverage" indicates that this sort of insurance has a fixed costs and face amount (death benefit) throughout the life of the policy. Merely placed, when individuals talk concerning term life insurance, they typically refer to degree term life insurance policy. For most of individuals, it is the simplest and most budget-friendly option of all life insurance policy kinds.

The word "term" below refers to a given variety of years during which the level term life insurance policy stays energetic. Degree term life insurance is just one of one of the most prominent life insurance policy plans that life insurance policy carriers offer to their customers because of its simplicity and price. It is additionally very easy to contrast level term life insurance policy quotes and get the best costs.

The device is as follows: To start with, select a plan, survivor benefit amount and policy duration (or term length). Secondly, select to pay on either a monthly or yearly basis. If your premature death happens within the life of the plan, your life insurer will pay a swelling amount of survivor benefit to your established recipients.

What does a basic Level Term Life Insurance Policy plan include?

Your degree term life insurance coverage policy expires once you come to the end of your policy's term. Option B: Purchase a new level term life insurance policy.

FOR FINANCIAL PROFESSIONALS We have actually created to provide you with the best online experience. Your present browser may restrict that experience. You may be utilizing an old web browser that's in need of support, or setups within your internet browser that are not suitable with our site. Please conserve on your own some irritation, and upgrade your internet browser in order to watch our website.

What is the most popular Level Term Life Insurance Vs Whole Life plan in 2024?

Currently making use of an upgraded web browser and still having problem? Your existing web browser: Detecting ...

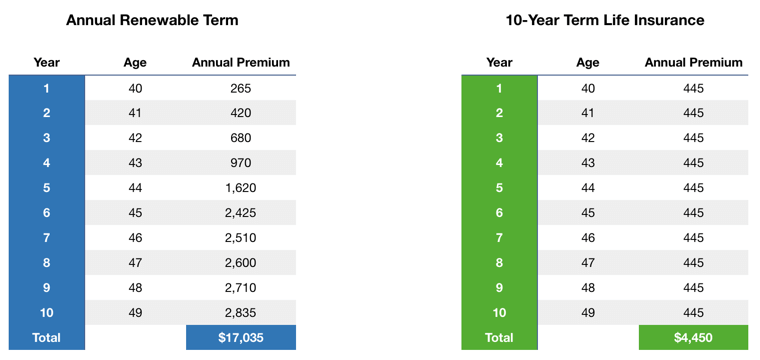

If the policy expires plan your death or you live beyond the past term, there is no payout. You might be able to renew a term plan at expiration, however the costs will be recalculated based on your age at the time of revival.

Whole Life Insurance Fees 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Resource: Quotacy. Quotes are for a $500,000 permanent life insurance coverage policy, for males and women in excellent wellness.

Who offers Level Term Life Insurance Policy Options?

That lowers the total threat to the insurance firm contrasted to a long-term life policy. The lowered danger is one factor that enables insurers to charge lower costs. Rate of interest, the financials of the insurance coverage firm, and state guidelines can likewise impact costs. In general, firms usually use better prices at the "breakpoint" coverage degrees of $100,000, $250,000, $500,000, and $1,000,000.

He buys a 10-year, $500,000 term life insurance plan with a premium of $50 per month. If George dies within the 10-year term, the plan will pay George's beneficiary $500,000.

If he lives and restores the policy after 10 years, the costs will certainly be higher than his preliminary policy since they will be based upon his current age of 40 as opposed to 30. Level term life insurance. If George is identified with a terminal illness throughout the first policy term, he possibly will not be eligible to restore the plan when it ends

There are a number of kinds of term life insurance policy. The ideal choice will certainly depend on your individual conditions. A lot of term life insurance policy has a degree costs, and it's the type we have actually been referring to in many of this short article.

Who offers Fixed Rate Term Life Insurance?

They may be a good choice for somebody who requires short-term insurance. The insurance holder pays a fixed, degree premium for the period of the plan.

Latest Posts

Securus Final Expense

Senior Final Expense Life Insurance Program

Senior Solutions Final Expense