Featured

Table of Contents

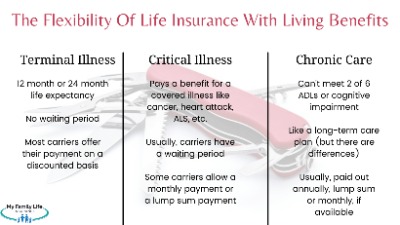

The lasting care rider is a sort of sped up fatality benefit that can be made use of to spend for nursing-home, assisted-living, or in-home treatment when the insured requires assist with tasks of daily living, such as showering, eating, and making use of the commode. A assured insurability biker allows the policyholder get added insurance policy at a later date without a medical testimonial. This possibility can come with high costs and a reduced fatality benefit, so it might only be a good choice for individuals who have maxed out various other tax-advantaged cost savings and investment accounts. The pension plan maximization technique explained earlier is another means life insurance can fund retired life. It's prudent to reevaluate your life insurance policy needs yearly or after significant life events, such as separation, marriage, the birth or adoption of a child, or significant acquisitions such as a house.

Insurers review each life insurance coverage candidate on a case-by-case basis. In 2023 there were more than 900 life insurance coverage and wellness companies in the United States, according to the Insurance coverage Information Institute.

You need life insurance policy if you require to supply safety and security for a spouse, youngsters, or various other relative in the event of your death. Life insurance policy survivor benefit can help beneficiaries repay a mortgage, cover university tuition, or assistance fund retirement. Long-term life insurance policy likewise features a cash worth component that develops gradually.

Life insurance survivor benefit are paid as a round figure and are exempt to federal revenue tax obligation because they are not thought about earnings for recipients. Dependents don't have to bother with living costs - Cash value plans. The majority of plan calculators advise a numerous of your gross earnings equivalent to seven to ten years that can cover major expenses such as home loans and college tuition without the making it through partner or youngsters having to secure car loans

What are the top Flexible Premiums providers in my area?

Once you choose what sort of insurance policy you require and just how much protection makes good sense for your circumstance, compare items from top life insurance coverage companies to establish the best fit.

Active employee has to be full-time (regular condition, 80% or better) or part-time (normal standing, 40%-79%) - Accidental death. If you elect reliant and/or spouse/qualifying grown-up protection, you will be needed to finish a Statement of Health and wellness. The Supplemental Life section of the plan offers additional security for those who depend on you monetarily

Advantage choices are available in various increments with the minimum advantage amount as $20,000 and the optimum advantage quantity as $500,000. If you are currently registered in Supplemental Life, you may enhance your protection by one level without a Declaration of Health and wellness. Any extra degree of coverage will certainly require a Declaration of Health.

No individual might be insured as a Dependent of more than one staff member. For your youngster to be eligible for coverage, your kid needs to: Be 14 days to 1 years of age for $500 or 1 year old up to 26 years for $10,000 (over 26 years might be continued if the Reliant Kid satisfies the Disabled Child needs) No person can be guaranteed as a dependent of greater than one employee If you end up being terminally ill due to an injury or health issues, you or your lawful rep have the choice to request an ABO.

How long does Level Term Life Insurance coverage last?

The taxed price of this team term life insurance coverage is computed on the basis of consistent premium rates figured out by the Irs based on the staff member's age. MetLife selected AXA Assistance U.S.A., Inc. to be the administrator for Travel Aid services. This solution helps intervene in medical emergency situations in international countries.

You will certainly owe tax obligations if any type of section of the amount you take out is from passion, returns or capital gains. Be conscious that the amount you take out will be deducted from the policy's death advantage if it's not paid back. You'll be charged rate of interest if you obtain a funding against your irreversible life plan, yet it's usually lower than the rate of interest charged by various other lenders.

What is Senior Protection?

It's a valuable living benefit to have when you think about that 70 percent of people transforming 65 today will certainly need some kind of lasting treatment in their lives.

Here's how: is a type of irreversible life insurance coverage (as is global and variable life). Permanent life insurance coverage policies will certainly permit you to access of your account while you're alive.

And you will not have immediate access to cash money once the plan goes live. You'll require an ample cash money quantity in the account before you can use it (and it takes time to develop that up).Obtain a totally free rate estimate now. Presuming you have a policy that has a money element to it, you could then surrender it and take out the whole existing money value.

It's a popular that you can't utilize your life insurance while active. Not only can you possibly use it, however it might additionally be a much better lorry than other kinds of credit history.

What is the process for getting Income Protection?

If you want the benefits this choice can manage then begin by getting a complimentary price quote. Matt Richardson is the handling editor for the Handling Your Money area for He creates and modifies web content about personal financing ranging from financial savings to spending to insurance policy.

Life Insurance coverage with living benefit motorcyclists offers economic defense throughout significant life occasions or wellness issues. These motorcyclists can be included to long-term and term life insurance policy policies, but the terms differ.

At its core, life insurance policy is designed to supply monetary security to your enjoyed ones in the event of your death. As the demands and needs of customers have evolved, so have life insurance coverage items.

Latest Posts

Securus Final Expense

Senior Final Expense Life Insurance Program

Senior Solutions Final Expense